Digital Assets: What Happens to Your Online Life When You're Gone?

May 08, 2025Your online presence extends far beyond social media profiles in today's increasingly digital world.

From cryptocurrency investments and online banking to photo libraries and email accounts, digital assets have become a significant part of our lives and estates.

But have you considered what happens to these assets when you're no longer around? Without proper planning, your digital legacy could be lost forever or inaccessible to your loved ones.

What Are Digital Assets?

Digital assets encompass everything you own that exists in electronic form, including:

- Financial accounts: Online banking, investment portfolios, PayPal, and cryptocurrency wallets

- Social media profiles: Facebook, Instagram, Twitter, LinkedIn, and others

- Digital purchases: Music libraries, e-books, movies, and games

- Intellectual property: Blogs, websites, domain names, and creative works

- Personal data: Photos, videos, emails, and documents stored in the cloud

- Business assets: Online stores, subscription services, and digital business tools

These assets often hold both financial and sentimental value, making them an essential part of your estate planning.

The Digital Afterlife Problem

According to recent studies, the vast majority of adults under 45 don't have a will, and even fewer have considered their digital assets in their estate planning.

This widespread oversight can lead to several challenges:

- Password barriers: Without login credentials, family members may be unable to access your accounts.

- Legal hurdles: Many digital services have terms of service that prohibit account transfers, even after death.

- Lost assets: Cryptocurrency keys or valuable domain names may go undiscovered or permanently inaccessible.

- Privacy concerns: You might want certain digital content to remain private or be deleted after passing.

- Identity protection: Unused accounts can become targets for identity theft.

Creating a Digital Estate Plan

To ensure your digital assets are handled according to your wishes, consider these essential steps:

1. Create a Digital Asset Inventory

Start by identifying and documenting all your digital assets.

Include:

- Account names and what they contain

- The device or platform where they're stored

- Their approximate financial or sentimental value

- What do you want to happen to each asset (transfer, delete, memorialize)

2. Appoint a Digital Executor

Choose someone you trust to manage your digital assets after your passing.

This person should be:

- Tech-savvy enough to navigate various platforms

- Trustworthy with sensitive information

- Willing to follow your wishes regarding your digital legacy

Consider whether this should be the same person as your primary estate executor.

3. Address Access Issues

Create a secure method for your digital executor to access your accounts:

- Consider using a password manager that allows emergency access

- Create a secure document with access information that can be stored with your will

- Update this information regularly, as passwords change

4. Include Digital Assets in Your Will

Formally incorporate your digital assets into your legal estate planning:

- Reference your digital asset inventory in your will

- Provide clear instructions for your executor

- Update your will as you acquire new digital assets

5. Understand Platform-Specific Policies

Different digital services have varying policies for handling accounts after death:

- Facebook allows accounts to be memorialized or deleted

- Google offers an Inactive Account Manager to determine what happens to your data

- Apple, Microsoft, and many financial services have their own protocols

Research the legacy options for your most valuable or important digital accounts.

Legal Considerations for Digital Assets

The legal landscape surrounding digital assets after death is still evolving.

Consider these points:

- Terms of Service agreements often restrict account transfers, even to heirs

- The Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA) gives executors limited legal authority to access digital accounts

- International accounts may fall under different jurisdictions with varying laws

- Cryptocurrency requires special planning due to its decentralized nature

Protecting Your Digital Legacy

Your digital footprint tells your story. By taking proactive steps now, you can:

- Ensure valuable digital assets transfer to your beneficiaries

- Preserve cherished memories for future generations

- Protect your privacy and online identity

- Reduce stress and complications for your loved ones during an already difficult time

Taking Action Today

Don't leave your digital afterlife to chance.

In our connected world, including digital assets in your estate planning is no longer optional—it's a necessity.

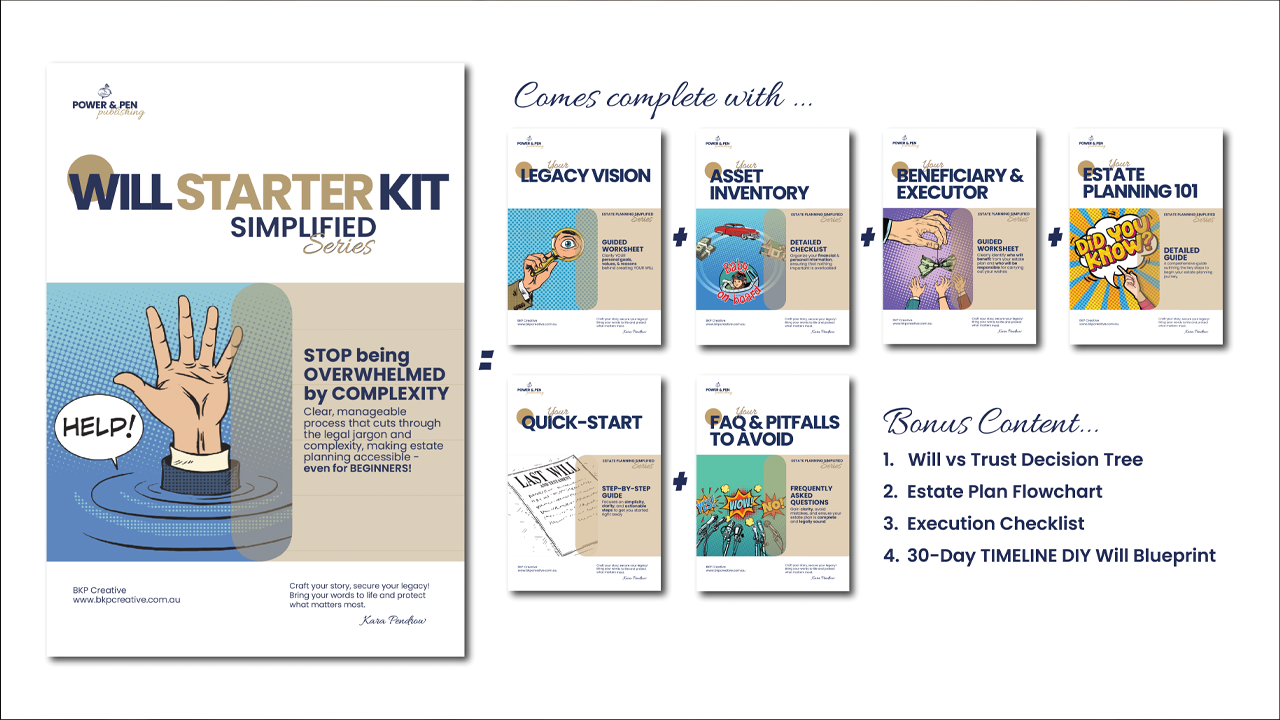

Ready to protect your digital legacy? Our Free Will Starter Kit includes specific guidance for documenting and managing digital assets as part of your comprehensive estate plan.

This easy-to-use resource will help you take the first steps toward securing your entire estate, both physical and digital.

Download Our Free Will Starter Kit Today and ensure your digital legacy remains accessible and protected for your loved ones. It also includes a basic will template tailored for jurisdictions in the United States, the United Kingdom, Canada, Australia, and New Zealand.

This blog post is for informational purposes only and does not constitute legal advice. For specific legal guidance regarding your digital assets and estate planning, please consult with a qualified attorney in your jurisdiction.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.